The €60 billion Brexit bill: How to disentangle Britain from the EU budget

- Britain’s EU exit bill is possibly the single biggest obstacle to a smooth Brexit. The European Commission calculates that the UK has €60 billion of charges to settle. Britain is confident it will face down what it considers to be spurious demands. Both sides are entering the Brexit money negotiations with unrealistic expectations. Ultimately, this political collision could bring the Brexit talks to a sudden and premature end.

- The issues are surmountable. In pure economic terms, even that €60 billion estimate is relatively insignificant, especially when paid over many years. But disputes over EU money are almost always highly-charged and occasionally nasty. A mismanaged negotiation of the bill could easily poison Brexit divorce talks and future UK-EU trade relations.

- The make-up of the bill is little understood, even by EU-27 countries. The €60 billion covers Britain’s potential obligations in three main areas: legally binding budget commitments that will be paid after Britain leaves; pension promises to EU officials; and contingent liabilities – such as bailout loans to Ireland – that would only require payments in certain circumstances.

- The most legally contentious relate to support for EU investment projects that will be paid for after Britain leaves. These liabilities come in two forms: project commitments that have yet to be paid; and structural funds promised to EU member-states, which will largely be turned into ‘budget commitments’ and paid for between 2019 and 2023.

- Both sides are confident in their legal case, and it is hard to predict who would prevail in court. There are few clear legal precedents regarding the liability of departing members of international organisations. But in the Brexit talks, the issues will largely be settled by politics, not law. Some EU negotiators want Britain to promise to honour its financial obligations as a precondition for trade and transition talks.

- The EU-27 are confident Britain will eventually pay, because the costs of a disorderly Brexit are much higher. Theresa May is open to limited contributions to participate in future EU programmes. But she has ruled out paying "huge sums" to the EU after Brexit. An angry reaction in Westminster to a perceived ransom demand from Brussels would further constrain her options.

- There are differences in view between the EU institutions and the EU-27 member-states. Some countries were surprised by the Commission’s aim-high approach. But over time, they could harden their positions and rally around the Commission. After all, Britain’s exit leaves a significant gap in the EU budget. Net-contributors do not want to pay more, and net-recipients do not want to lose out.

- Any compromise should be built around three broad principles: on an annual basis, any UK legacy payments must be less than its EU membership contribution; the settlement should be presented as ‘Brexit implementation costs’ rather than tied to specific liabilities, like EU pensions; and Brexit should not leave the EU out of pocket for the last two years of its current long-term budget (2019 and 2020). Britain should separately negotiate terms and contribution rates to stay in EU research programmes and the European Investment Bank.

“I want my money back ... I must be absolutely clear about this. Britain cannot accept the present situation on the budget. It is demonstrably unjust. It is politically indefensible: I cannot play Sister Bountiful to the Community.”

Margaret Thatcher at the Dublin Summit, 1979

“On June 23rd we will face a historic choice ... to take back control of huge sums of money – £350 million a week – and spend it on our priorities such as the NHS.”

Boris Johnson, ITV referendum debate, June 2016

“The principle is clear: the days of Britain making vast contributions to the European Union every year will end.”

Theresa May, Lancaster House speech, January 2017

A bill of up to €60 billion is standing in the way of Britain’s smooth exit from the EU. It is a withdrawal charge bigger than the UK’s annual defence budget, and a far cry from the £350 million-a-week bounty promised by Brexit campaigners during the referendum campaign. Few understand how it is calculated by the European Commission, or what impact the negotiations over it will have on British domestic politics. But ultimately it will confront Westminster with a problem over which the Brexit talks could collapse.

Made up of promises accumulated since 1973, the bill includes financial liabilities that stretch decades into the future, for longer, indeed, than the UK’s 40-odd years of EU membership. Pension pledges, infrastructure spending plans, the decommissioning of nuclear sites, even assets like satellites and the Berlaymont building – all these must be divvied up in a settlement if Brexit is to be anything but a hard, unmanaged, unfriendly exit.

There is something about negotiating budgets that raises the hackles of EU leaders. Small as it is in national terms – under 2 per cent of public spending by member-states – the EU budget has always been an outsized source of tension in Brussels and Westminster. One of the European project’s earliest and biggest crises – the 1960s French ‘empty chair’ – was sparked by a dispute over Community spending. And since then it has regularly brought out the Scrooge in Europe’s statesmen, with national leaders arguing late into the night over as little as a few hundred million euros.

Part of the reason is that budget squabbles are about more than money; they are a quantifiable, bankable measure of diplomatic prowess. And when Margaret Thatcher refused to “play Sister Bountiful” to the Community and won a rebate for her doggedness, she also secured a special place for the EU budget in British political lore.

Remarkably, the possibility of an EU exit charge never featured in the UK’s referendum campaign. And since that vote, a chasm has opened between UK and EU-27 expectations. The Commission surprised even EU-27 member-states with its unofficial €60 billion estimate. But it is determined to collect those dues, or at least make member-states realise what it would cost them to let Britain off the hook.

Some of the legal arguments supporting the €60 billion bill are at best untested and at worst tenuous. But the Commission knows it has a largely plausible case and it is in the driving seat of the negotiations; whatever the size of the exit bill, for Britain it will dwarf the cost of walking away and wrecking relations with its main trading partner. The Commission sees the laws of political gravity on its side. And in pure financial terms, for once the EU-27 net contributors to the budget and the net recipients are united. It is in everybody’s interest to make Britain pay.

That sets the stage for a dangerous stand-off. These budget issues are still little understood in Westminster. When the Financial Times first reported that the size of the exit bill was €20-40 billion, ardent Brexiters barely made a fuss. When the paper reported that the Commission was using more aggressive assumptions and floating figures of €40-60 billion, again there was hardly a murmur from London. Some dismissed it as irrelevant because Britain would not pay a penny; others saw the advantages of a nasty falling out over money in advancing the case for a sharp break from the Union.

Britain will refuse the basis of the €60 billion bill. May’s Brexit negotiators feel the law and common sense is on their side. As a negotiating tactic, however, they also know money is leverage. It is a telling fact that within the Department for Exiting the EU, ‘market access’ and the ‘budget’ are grouped within the same directorate. And in her Lancaster House speech, May left open the possibility of making “appropriate” payments to the EU in future for participation in “specific programmes”.

But in Westminster this is seen as a minimal fee to secure future benefits, such as co-operating on research funding, not legacy costs. That assumption was gold-plated by May promising to end “vast contributions”, and to ensure that after leaving “we will not be required to contribute huge sums to the EU budget”. Those words leave some room for manoeuvre on the €60 billion bill. But not much.

How does the EU justify the €60 billion?

EU budgeting is complex. But the Commission sees the issues at stake as quite simple. Britain made legally-binding financial commitments to the EU that it must honour, whether it is inside or outside the Union. To reject these financial obligations would imperil Britain’s standing as a law-abiding member of the international community.

The EU budget is the biggest multinational attempt to pool money in history. Running at around €142 billion this year, the core EU budget is more than five times the size of the combined spending of UN agencies. But in national terms, it remains relatively small beer, just 1 per cent of the EU’s GDP.

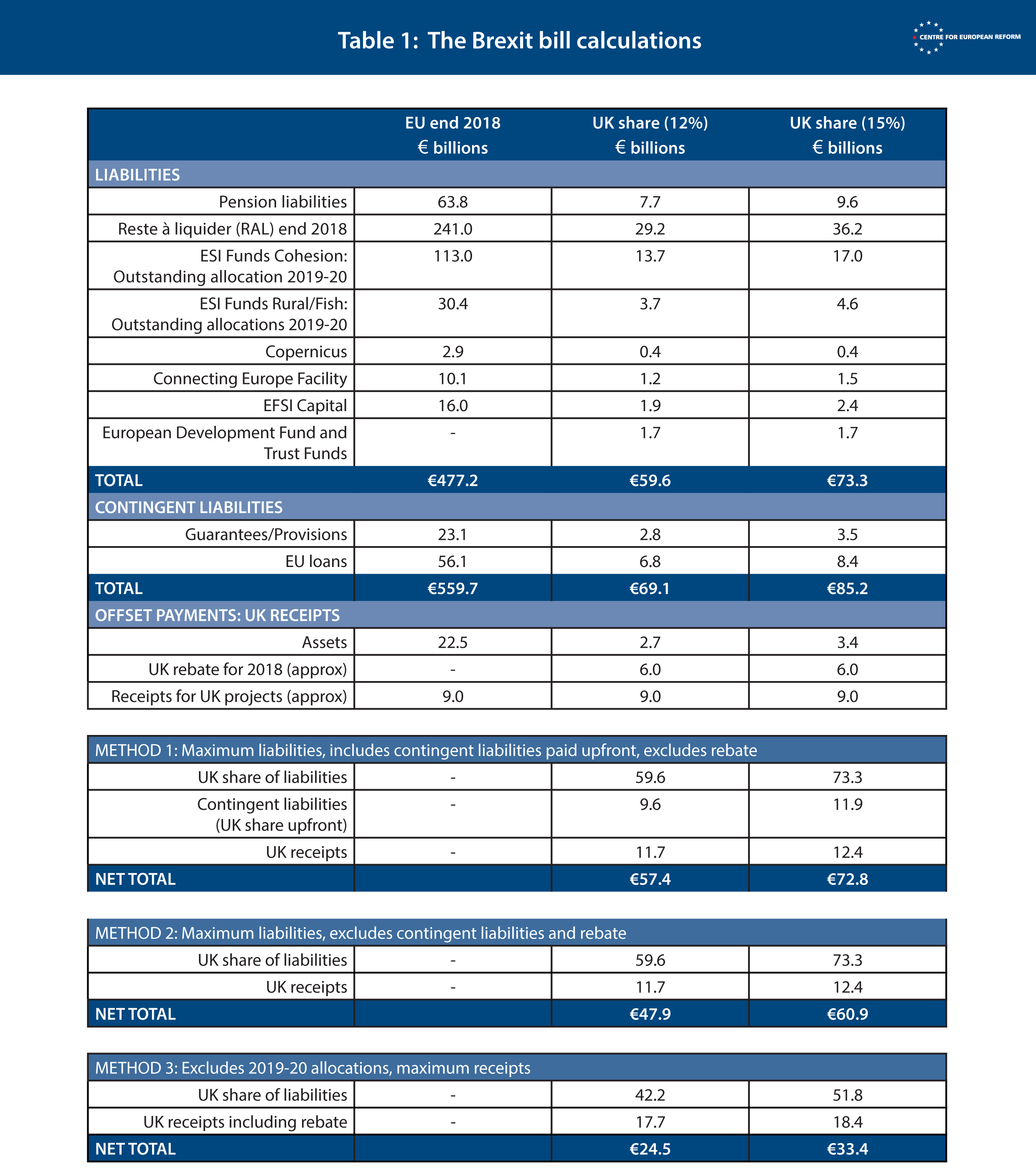

Britain’s exit charge is calculated by valuing the EU’s assets and liabilities at the point of the UK’s exit, and dividing the net liability by the UK’s share of EU budget contributions (around 12-15 per cent). The calculations, and indeed the principles behind them, are naturally tremendously contentious.

The key reference point is the EU’s consolidated annual accounts. These 143 pages cover the main areas but they are not entirely comprehensive. There are some off-balance sheet items – such as obligations to the European Investment Bank, or development spending – which make the calculation more complex. The Commission will aim for a single, consolidated financial settlement for Brexit under Article 50.

The Commission sees the issues at stake as quite simple. Britain made legally-binding financial commitments to the EU.

As an opening gambit Michel Barnier, the EU’s chief Brexit negotiator, will start high. He has told some EU officials he will demand an exit settlement of €40-60 billion, others that it will be €55-60 billion. The detailed calculations have not been shared, even with the EU-27. But the principles are becoming clearer. This paper independently calculates the exit bill on the basis of those principles, using publicly available data.

The main parts of the bill are unpaid budget appropriations (basically the EU’s credit card)1; unused national allocations of investment spending, which Britain approved for the 2014-20 period; and the cost of the pension promises made to EU officials. The obligations are partly offset by flows of money back to Britain from its share of assets, budget receipts and the payment of the UK rebate.

The liabilities: Unpaid commitments

Much of EU spending relates to projects that are approved and paid for over a period of several years. This multi-annual structure is particularly important for ‘cohesion’ spending, which aims to raise living standards in parts of the Union that are economically lagging.

For the past decade, much of that funding has been devoted to reducing the economic gap between regions, particularly in the eight ex-communist countries that joined the Union in 2004. Both directly and indirectly Britain played a role in supporting this expenditure; it pushed for more regional spending when it first joined, and was one of the biggest champions of enlargement.

These alleged obligations roughly fall into two categories: unpaid expenditure comitments made in annual budget rounds prior to 2019 (the reste à liquider); and additional legal promises to provide investment funding that will appear as a specific project commitment in annual budgets after 2019 (outstanding spending allocations).

Reste à liquider (RAL)

Roughly translated as “yet to be paid”, the reste à liquider is essentially a €241 billion bill that has ballooned since 2000 as the EU has piled on projects to its schedule of works and investment. While that €241 billion must be paid by all member-states of the EU, it represents the biggest portion of the Brexit charge.

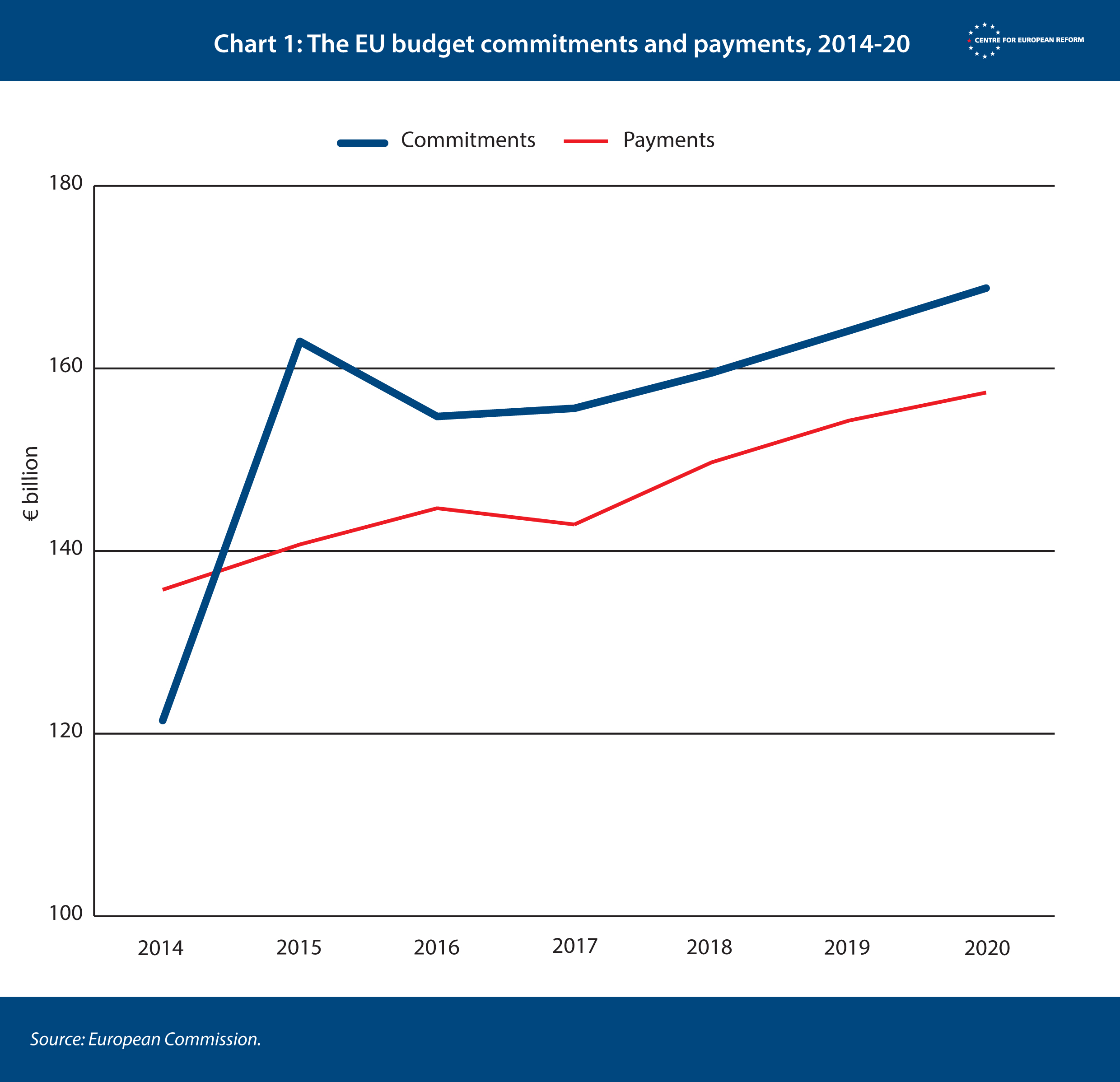

It effectively arises from political divisions over the EU budget, which mean the EU systematically commits to more spending projects than its member-states are willing to pay for in a given year. This is managed through a forked accounting method. Inspired by a bygone French bookkeeping technique, the EU adopted a system of budgeting that splits its accounts into ‘commitments’ (basically appropriations to spend money for a specific purpose or project) and payments (to actually execute those commitments).

The EU’s long-term budget sets ceilings for both annual commitments and payments. But crucially, the annual commitment ceiling is almost always bigger than payments. That leaves a (usually increasing) overhang of unpaid commitments. So in a typical budget year, the EU can be paying for the implementation of commitments first registered in the EU’s annual budget anywhere from one and 20 years previously. Most commitments from the 2014-20 budget are supposed to be paid for by 2023.

This runs against the grain of the British public finances, which operate on the basis of accruals. If a high-speed rail line is approved in the UK, it will only appear in the annual budget once a payment is actually made.2

Britain’s fixation with payments has driven its diplomacy in Brussels. Along with other net-contributor states, it saw the giant RAL as proof of financial mismanagement by the Commission.3 In practice the Treasury’s strategy for parsimony was to largely ignore the overhang, and instead focus on maintaining discipline over annual payments, much to the irritation of the Commission and European Parliament.

That largely worked for London. But Brexit may have dramatically changed the calculus. The RAL will stand at up to €241 billion by the end of 2018, a few months before Britain’s expected exit date from the EU. More than half is made up of cohesion spending, and a fifth each by research and agricultural spending. As a result of the latest long-term budget being delayed, the EU is off to a later start on big project spending than usual; most of the cohesion spending is backloaded, to be executed in the years after the UK has left.

Britain’s share of the RAL, based on its typical contribution rate, would be around €29-36 billion.

Outstanding spending allocations

When the Financial Times first attempted to estimate Britain’s exit bill in October 2015, it put the gross figure at €40 billion. That fitted the initial calculations of several EU-27 member-states. But it fell short of the Commission’s estimate for one main reason: it assumed Britain would not be liable for any budget commitments made after 2019. There was, in other words, a cut-off date for commitments.

Barnier takes a more expansive view of Britain’s liabilities. The Commission’s argument is that the UK jointly approved around €143 billion of investment spending that is legally binding on the EU but will only be paid once Britain has left. In EU law, these are legal commitments that become budget commitments once money is reserved to pay for them in the EU’s annual budget round. The pledges are in addition to the commitments already in the RAL, and the Commission wants Britain to honour its share. It is by far the most contentious part of the exit bill.

Some have wrongly assumed Mr Barnier is demanding Britain pay the final two years of the EU’s long-term budget, the Multiannual Financial Framework, which runs from 2014-20. Legally there is an important distinction. The crucial issue for him is not the MFF and its budget ceilings, but the laws underpinning it from which the legal commitments flow. These ‘allocations’ are basically investment funding promises – legal obligations on the EU – that are not included in the RAL at present, but will be in future.

An obscure law – Regulation No. 1303/2013 – is critical. Dubbed the ‘common provisions’ regulation, few in the UK would ever have heard of it. But it may leave Britain on the hook for its share of the €143 billion of cohesion and rural development spending executed after Brexit.

This ‘common provisions’ regulation lays down the rules and allocated resources for the European Strategic Investment Funds (ESI Funds), which are sometimes known as structural funds.4 Most significantly for Brexit talks, Article 76 empowers the Commission to agree programmes and promise resources to individual member-states for these projects. Spending promises in these ‘programmes’ are a binding EU legal commitment, which appear as a liability on its accounts.5

The cost of retirement benefits for EU officials may well be the most politically charged issue.

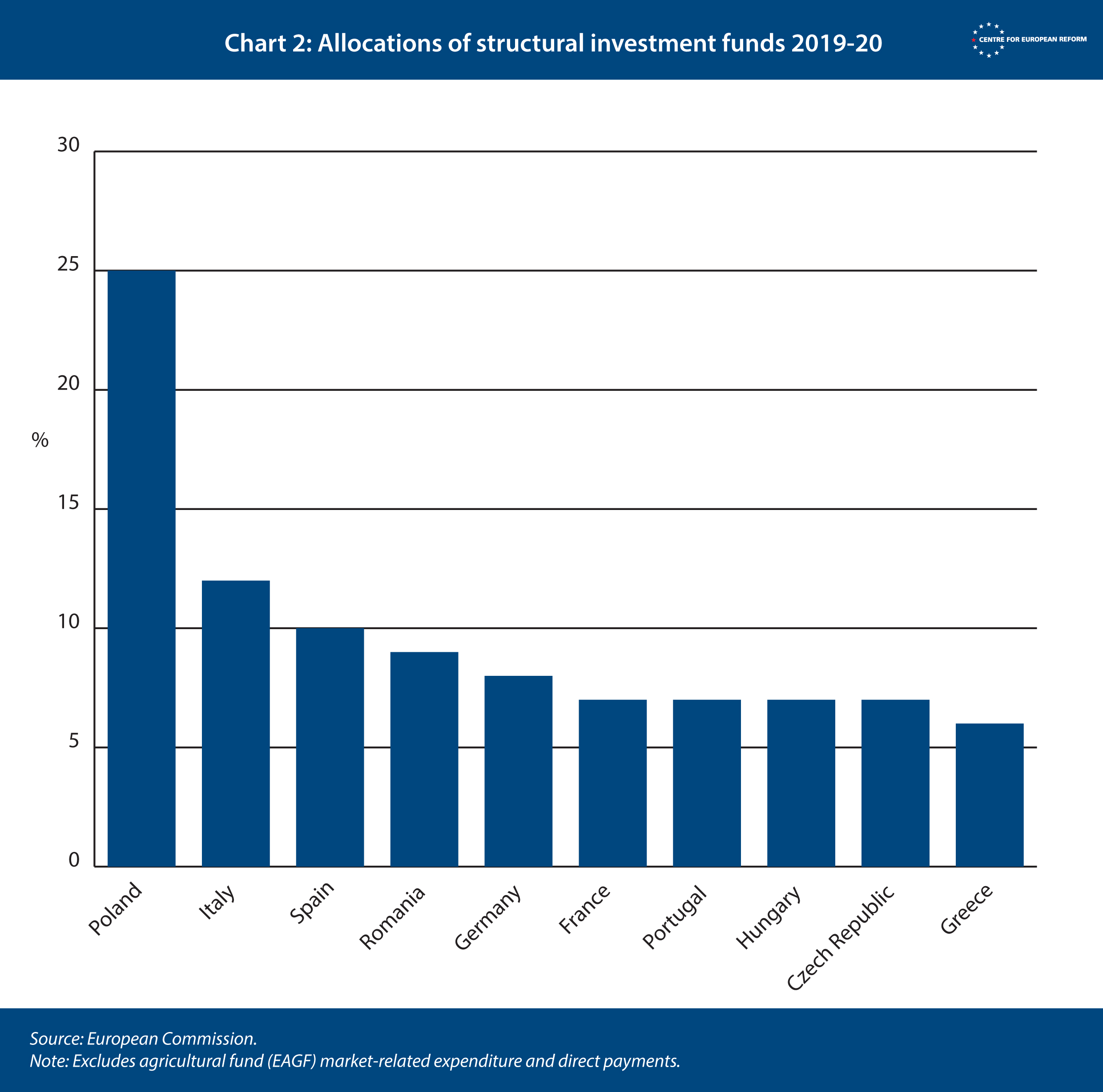

This form of spending has special political resonance because it amounts to a direct funding pledge to a member-state. Under cohesion spending, Poland stands to receive €82.2 billion in 2014-20, and €23.1 billion will be paid respectively to Hungary and the Czech Republic (see Chart 2).6 It is the main fruit of the EU budget for many net-recipient countries. And these national allocations – or ‘envelopes’ in the Brussels jargon – are the basis on which member-states proceed with finding, scoping and initiating investment projects.

The trouble is that only 25-30 per cent of the biggest ESI cohesion funds will have actually been spent by the time Britain leaves the Union in 2019 (see Chart 3).7 Britain’s share of the rest is up for negotiation. And if it is not paid by Britain, the Commission sees it as a liability of the Union that must be paid by other EU member-states.

The liabilities: Pension promises to EU officials

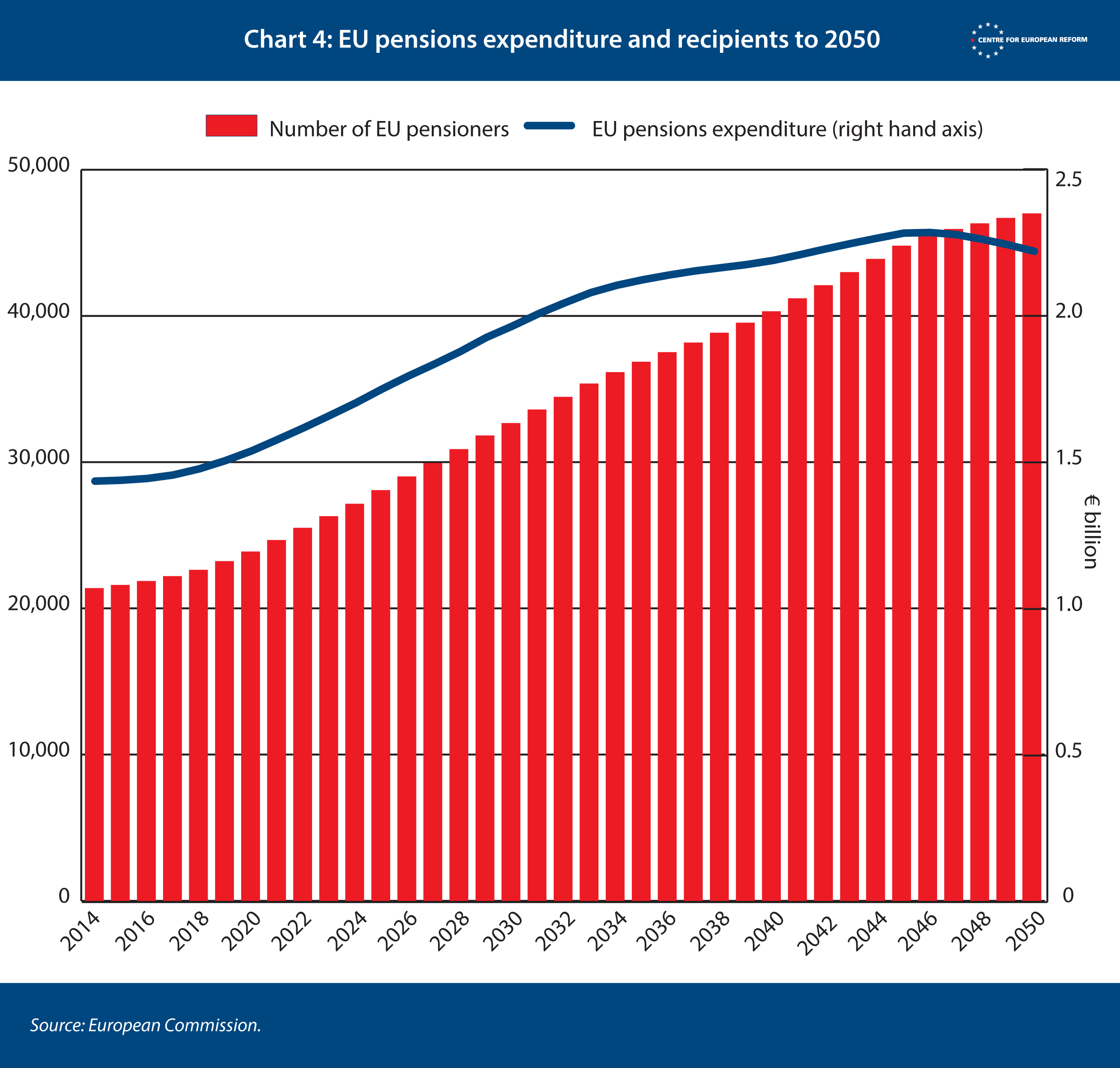

The cost of retirement benefits for EU officials – a liability of €63.8 billion – is not the biggest part of the Brexit bill. But it may well be the most politically charged issue. Costs will run decades into the future, for as long, indeed, as a eurocrat would hope to live.

The Pension Scheme of European Officials (PESO) is extremely generous by comparison to the private sector and most EU public sector schemes. In 2014, the average retirement benefit was €67,149 a year.8 It is also wholly unfunded. Like most British public sector pensions, it operates on a ‘pay as you go’ basis, with costs covered by the annual EU budget as they arise. There is no pension fund.

The legal basis for this is Article 83 of the Staff Regulations:

Benefits paid under this pension scheme shall be charged to the budget of the Communities. Member-states shall jointly guarantee payment of such benefits in accordance with the scale laid down for financing such expenditure.9

Officials are supposed to cover a third of the cost of their future benefits through a contribution amounting to around 9 per cent of salary, around €426 million in 2016. There are more active EU staffers than retirees at the moment, and their annual contributions currently exceed pension expenses. But the payments are not set aside for the future, when pension costs will rise (see Chart 4).10 Instead they are ploughed into the general EU budget and spent.

It is unclear why a pension fund was not established when the PESO scheme was set up in 1962. There was initially a fund for European Coal and Steel Community staff, but this was dismantled. One senior EU official described PESO as “a giant Ponzi scheme”. That is unfair of course, but only to the extent that the guarantees offered by member-states are honoured in the future.

In its Brexit settlement, one option would be for the UK to cover the costs of the Brits within the EU institutions. Around 3.8 per cent of serving EU officials hold British passports, and Brits make up almost 8 per cent of the roughly 22,000 drawing benefits from the PESO scheme. Paying their benefits would cost €80 million this year.

But the Commission sees London as liable not just for British nationals working for the EU, but for its share of promises made to all EU officials – that is, its share of the full €63.8 billion shown in the EU consolidated accounts. To the Commission, the nationality of officials is beside the point: they all worked for the Union when Britain was a member. As a lump sum that amounts to a liability of some €7-10 billion – a similar amount to the cost of building Britain’s two new aircraft carriers. Alternatively Britain could agree to cover its share of annual expenditure, around €120 million this year, rising to €218 million by 2045.

The liabilities: Other legal obligations

The Commission will seek to secure Britain’s share of funding for those commitments that are seen as legally binding, either because they are in multi-annual allocations, or arise from contracts that have already been signed. Examples include:

- Connecting Europe Facility (CEF): EU liability €10.1 billion. The CEF funds cross-border European infrastructure projects for energy, transport and telecommunications.

- Copernicus and Galileo programmes: EU liability €3.1 billion. The Copernicus European system involves developing and building a network of observational satellites and sensors for monitoring the earth from space. Galileo is Europe’s Global Navigation Satellite System, which is also under development.

- Miscellaneous: EU liability €3.4 billion. The EU has various unspecified contractual commitments, including around €2 billion relating to nuclear fusion research, and €388 million for building contracts for the European Parliament. The EU also owes €373 million under fishing agreements.

- European Fund for Strategic Investments (EFSI):

- EU liability €16 billion. Known to some as the ‘Juncker Plan’, the EFSI aims to stimulate private investment in infrastructure projects by using €16 billion of guarantees from the EU budget to the European Investment Bank (EIB).

- Contingent liabilities and off-balance sheet items. Contingent liabilities are EU payment obligations triggered by specific circumstances. Calculating an exit ‘share’ is much harder because it requires quantifying, say, the risk of Ukraine or Portugal defaulting on their EU loans. The main examples include:

Guarantees and provisions: €23.1 billion.

These are mostly budget guarantees on loans granted by the EIB to non-EU countries, including countries in membership talks. In addition there are guarantees related to research projects under Horizon 2020 and other smaller initiatives. There are around €1.7 billion of other provisions, which mainly relate to the clean-up costs of some nuclear sites.

Loans: €56.1 billion.

The EU has extended loans through three main facilities: Macro-financial assistance (MFA), Balance of Payments (BOP) assistance and the European Financial Stabilisation Mechanism (EFSM). At the point the 2015 EU accounts were drawn up, these included outstanding loans to Hungary (€1.5 billion), Ireland (€22.5 billion), Portugal (€24.3 billion) and Ukraine (€1.2 billion).

The main question with all the contingent liabilities is how to account for the downside risks. Some loans are obviously more risky than others. Ireland is hardly on the verge of bankruptcy. But guarantees on some EIB loans may well be called, and a Ukrainian default is far from inconceivable.

There are three main ways to divvy up any losses. One is to require a contribution when and if necessary. Another way would be for the UK to pay its whole share of the contingent liabilities upfront, and for the EU to eventually reimburse it with any unused money. That is perhaps the most implausible, but may nonetheless be the Commission’s starting point in talks.

A third option is to calculate the risk on each loan or guarantee. That would again require upfront cash, and could easily open the door to two years of squabbling over these calculations alone.

The crucial point from the EU perspective is that a sound relationship would be required with the UK, in order for it to have confidence in a payment plan that defers contributions.

Off balance-sheet items.

The most significant commitments excluded from the EU’s consolidated accounts relate to the EIB. And indeed due to the sheer complexity of the issues at stake – and parallel negotiations about continued UK participation – the EIB is excluded from this paper’s exit bill calculations.11

The second relates to development spending and trust funds. Britain made legally binding commitments to the European Development Fund, which is outside the EU budget but managed by the Commission. Member-states are expected to contribute approximately €9 billion in 2019 and 2020. The UK contributes around 15 per cent of the fund, which amounts to €1.4 billion of unpaid commitments post 2019. Separately Britain has also made pledges totalling some €327 million to various EU ‘trust funds’, offering financial assistance to refugees in Turkey, Africa and Syria.

The offset: Assets, rebates, inflows and the UK share

Britain’s exit obligations are expected to be offset by its share of EU assets. In the EU’s accounts, the EU’s total assets amount to €8.6 billion of property, plant and equipment, and €13.9 billion of assets available for sale.

These cover an eclectic assortment of items, from €2.1 billion of Galileo project satellites to the Berlaymont Commission headquarters, with a book value of €344 million, and an EU outpost in Dar es Salaam. The EU also owns the former headquarters of the British Conservatives in Smith Square, Westminster.

There may well be a disagreement over the value of these assets; Britain could demand a revaluation to capture their present market value, which is likely to be higher than the book value, which was the price originally paid. The Commission will insist on sticking to the book value in accounts.

Some money would also flow back to the UK from the EU budget if it were still a member. The biggest item is the last payment of Margaret Thatcher’s rebate. This is disbursed in the following budget year, meaning Britain should receive around €5-6 billion in 2019, after it has left (if relations are amicable).

On top of that, if Britain accepts it is responsible for a share of past commitments, it will doubtless demand its share of RAL and cohesion spending as well. It is hard to calculate Britain’s expected share of receipts from public data. In private discussions between EU institutions and officials from member-states, a figure of €9 billion is currently being netted off Britain’s gross bill. For simplicity I have used this estimate in my calculations.

Taking account of these receipts – assets, spending plans in the UK, and the rebate – provides a net figure for the UK bill.12

The final question is how to calculate Britain’s share. This is also likely to be contentious. In principle, Britain would want this to be based on its average contributions after the rebate. Using this method, its net share comes to 12.1 per cent, based on an average of the years 2012-16.

However, some EU officials in the Commission and Council want to calculate Britain’s share based on its gross national income alone. Using the pre-rebate contribution rates, the UK share rises to around 15 per cent.

The calculation method

Method one in the table below calculates a net exit bill of €57-€73 billion, depending on whether the UK share of liabilities is 12 or 15 per cent. It takes a maximalist view of Britain’s obligations, while minimising UK receipts by excluding the 2018 rebate payment. It would also require Britain to pay for its share of contingent liabilities upfront, with the expectation that unused funds would be paid back. This would be the most hardline EU-27 opening position.

Method two estimates the bill to be €48-€61 billion. This is the calculation that is closest to the €60 billion figure that the Commission is likely to demand. It takes an ambitious view of Britain’s legal commitments to spending after 2019. But unlike method one, it excludes contingent liabilities. In line with the Commission’s practice, Britain’s approximately €6 billion rebate for 2018 is excluded from the exit bill calculation (although it would still be paid).

Method three calculates a net bill of €25-€33 billion, which is more aligned with the initial views of some net-contributor countries. This requires Britain to honour commitments made in annual budgets – but no more. It excludes contingent liabilities and includes the rebate in the calculation of receipts.

How solid are the Commission’s arguments?

Britain’s exit bill is not easy to explain in everyday terms. And the Commission’s legal arguments are plausible but far from bulletproof. It might struggle to win a case in court. But the crucial point is that the technical details are probably going to be a secondary issue. The Brexit money dispute will begin as law, and conclude as politics.

The legal situation

There are some, but not many, potentially relevant precedents. International organisations have in the past chased up departing members for old debts, admittedly in some terrifically awkward circumstances. Brexit negotiators have looked at the League of Nations dissolution, for instance, a sorry affair that saw Ethiopia harried for unpaid budget dues (albeit with a one-year discount in fees to acknowledge the Italian invasion of 1935).

The collapse of the International Tin Council in the mid-1980s offers some other legal pointers, particularly on the issue of legal liability.13 The ITC left debts of £900 million and its creditors sought to recover some of it from members (which incidentally included the then European Economic Community).

Like the EU today, the ITC had a separate legal personality, able to enter agreements in its own right. That is important in determining the liability of members. Britain and other ITC members refused to compensate creditors, arguing that the organisation’s legal independence limited their secondary liability. The UK court rulings went in their favour, but as one appeal judge made clear there was “no clearly settled jurisprudence” about liability under international law.

The Brexit case is different but turns on a related question. As the EU is a separate legal entity, Britain would argue that its financial obligations must be covered by the EU’s own assets, or through funding requests to members at the point of need. Britain paid its annual dues as a member. Its liability would basically start and end with membership; with the payment of its final annual budget it would have honoured its obligations.

By contrast, underlying the Commission’s legal analysis is an assumption that it ultimately has a claim on Britain’s past commitments. Brussels reads the EU treaties as casting all member-states as jointly and severally liable for the Union’s debts. Indeed these treaty promises to provide financial support 14 underpin the EU’s Aaa or AA credit rating (granted in spite of the Union’s liabilities substantially exceeding its assets).

Moreover, the EU will say Britain did not just passively accumulate the liability, it positively acted to create the financial commitments. The Union’s long-term budget is agreed by unanimity, as are the Council regulations that allocated cohesion spending ‘envelopes’ to member-states. Britain had the choice to block all these measures – it could have used a veto – but instead it gave its approval to laws enshrining every euro of the obligations.

Britain’s counter case turns on a narrower reading of its responsibilities under the treaty. The word ‘binding’ appears once with regard to the EU budget, and it relates to the annual budget, not overall commitments or future liabilities accrued by the Union. The annual budget round transforms commitments into payment requests, agreed through a legislative process. That – and only that – is a binding requirement on member-states. In the past the gist of this argument was backed by net-contributors such as Germany, the Netherlands and Sweden.

If negotiations collapse, the case is likely to end up in the International Court of Justice in The Hague.

In short Britain will insist that responsibility for the overhang of bills lies with EU institutions. The EU was funded on an annual basis but decided to live beyond its means. The Commission decided to run an unfunded pension scheme and make more commitments to investment projects than the money available in any given year. These decisions created liabilities that are the responsibility of the EU to meet, as a legal entity in its own right. They are not, in London’s view, strictly the responsibility of member-states and certainly not of a departing state.

London’s interpretation is partly backed up by credit ratings agencies, which have largely maintained their assessment of the EU’s creditworthiness not because Britain will honour its past commitments, but because the remaining EU states will pay its bills and have the means to do so. DBRS even excluded Britain from its ‘core group’ of contributors when reaffirming the EU’s AAA status after the referendum.

Finally there is the secession issue. Debt-sharing after the partition of a country represents a quite different question from Brexit. But since the UK vote to leave the EU, some old British government statements issued during the Scottish independence referendum campaign have been dredged up in Brussels and read with interest.

The UK Treasury analysis papers from 2013 on national debt and a sterling currency Union make two important points. Firstly, that “the international law principle of equitable division” would be applied to the UK’s assets and liabilities in any negotiations on Scottish independence.15 The EU will see that principle applying to Britain’s EU exit too.

The second point is that the UK would honour existing debts, but ask Scotland to take on “a fair and proportionate share”. The “full spectrum” of past, future and contingent debts and liabilities would have to be considered in exit talks, the Treasury said. The EU would expect nothing less in Brexit talks.

In response Britain may look back even further to past EU accession negotiations. Why was it, for instance, that when Austria joined the EU in 1995 there was no great budget reckoning? Austria was relatively wealthy and immediately became a net EU budget contributor. There was no netting process, in which its share of assets or liabilities were calculated and recognised. It just joined, taking on responsibility for pension promises stretching back almost 40 years. Britain will be hoping to leave in similar fashion. If the EU doesn’t bother to net-off assets and liabilities on entry, why should that be required on exit?

If negotiations collapse, the case is likely to end up in the International Court of Justice in The Hague. The key reference text will be Article 70 of the Vienna Convention on the law of treaties, 1969. Britain may opt to take its chances over the article’s meaning, hoping that it suggests Britain’s financial commitments to the EU would end if it left with no withdrawal agreement.

Article 70: Consequences of the termination of a treaty

1. Unless the treaty otherwise provides or the parties otherwise agree, the termination of a treaty under its provisions or in accordance with the present Convention:

(a) Releases the parties from any obligation further to perform the treaty;

(b) Does not affect any right, obligation or legal situation of the parties created through the execution of the treaty prior to its termination.

The political reality

Unless talks break down, the reality is that the size of Britain’s budget settlement will be a function of negotiating strength, rather than legal fairness.

The Commission’s €60 billion is an upper estimate of legal obligations, a starting point for talks. But regardless of the quality of the Commission’s legal arguments, the cash call can always be overridden if a weighted majority of the EU-27 decides to compromise in a withdrawal agreement.

That is good and bad for the UK. It means every element of the budget is theoretically negotiable. And Britain’s willingness to pay large sums would give London some potential leverage in talks.

Such a position would probably be intolerable for London. But Michel Barnier and the EU-27 will be sorely tempted to take such an uncompromising approach. They know that once Article 50 is invoked, the two-year clock is running against the UK. The tactical advantage is firmly on the EU-27 side. The simplest negotiating strategy will be brute force; laying out their expectations and brushing off British counter arguments with “oh, look at the time”.

Britain’s perceived debts may fortify support for that approach. The Commission is spending time explaining to net-recipient member-states how Britain’s €60 billion is not just theoretical; it represents cohesion money owed and promised directly to them.

Unless talks break down, the size of Britain’s budget settlement will be a function of negotiating strength, not legal fairness.

That plays to a bigger concern for the EU-27. Britain’s exit is a potential bomb under the politics of the EU’s shared budget. The €60 billion alone would mean Germany having to pay up to €15 billion extra by 2023 and the Netherlands an additional €4 billion, most of which will not flow back. Berlin in particular has no interest in topping up the spending, and wants commitments cut instead.

An even harder question may be what happens if the UK no longer makes a substantial ongoing annual budget contribution. Assuming future long-term budgets were flat, that would entail net-contributors covering the net UK contributions of €6-8 billion a year. Such financial sacrifices are of course possible; this is small change to some member-states. But the decisions will be taken in a far less forgiving political context than past MFFs. Germany and other net contributors are fed up with eastern member-states forgetting the spirit of solidarity when it comes to accepting migrants; some in Berlin and Brussels want to demonstrate the financial consequences of that in future budget settlements. This could easily turn ugly.

During the Brexit talks a number will eventually emerge on Britain’s bill. At that point the budget issue could take on a political life of its own on both sides of the Channel. In Westminster, if Brexit negotiating success is measured in money terms, it is hard to see how May will emerge victorious. Future payments could easily be sold to the public as an annoying but worthwhile price for implementing Brexit. But should Brexiters become unhappy with May’s handling of the exit negotiations, money is the perfect political weapon to drive home their point.

Similarly, Brexit brings an uncommon sense of unity to the EU-27 side over money; the net-recipients want what was promised, and the net-contributors do not want to pay more to cover for the absent British. These are relatively small sums compared to national budgets, but that has not prevented some ferocious summit squabbling in the past between EU leaders. If cash targets settle in their minds, it is hard to see what political constraints will naturally emerge to rein in EU-27 expectations.

Is there space for a compromise?

Some dangerous political forces are at play on the budget. Admittedly, we are still in a phase of diplomatic chest-beating. Talks have not started. But in Brussels there is evident confidence – perhaps even over-confidence – that Britain will ultimately have to pay its fair share. Little serious thought has gone into an extreme no-deal scenario. This is because officials in the Commission struggle to take seriously the prospect of Britain destroying its relations with its biggest trading partner and taking the risk of an unfriendly, unmanaged exit. Some think London is cornered.

At the same time the political ground has not been prepared in Westminster, where the complexities of the exit bill are not fully understood. Debate has focused on paying for future benefits, rather than settling old bills. May has raised expectations that the days of ‘huge’ multi-billion euro payments are over. Other Brexiters know the pledge to regain control of £350 million a week will not easily be forgotten by voters. The fighting spirit is hard-wired into British politics when it comes to EU budgets. Once the real politics hove into view for the Tory party, the scope for a serious compromise will narrow sharply. Britain’s political class may decide it is better to walk away than buckle to an unjust ransom demand.

The risk of a breakdown in talks is high. But if the issue is handled with care there is a potential landing zone. Finding it requires three presentational slights of hand.

First, any settlement payments must be significantly smaller than Britain’s old annual membership contribution. The UK Treasury, in its November 2016 budget, set aside what it would have paid in EU contributions after 2019 for other uses. To sell a deal, British politicians will need to be able to say Britain will meet its exit costs without any unplanned borrowing. This is hardly a £350 million-a-week windfall. But May needs to show some savings on annual contributions will be made. Stretching legacy payments out over many years would help, but May has indicated that she wants to avoid sizeable annual contributions.

Securing a contribution from Britain will at least delay the looming east-west standoff over money and solidarity.

This ties in with the second negotiating point: any exit payment needs to be presentable as an ‘implementation cost’ of Brexit. Linking charges to specific liabilities – especially when it comes to Eurocrat pensions – could make the deal unsellable to British voters and the press. Relating it to a specific benefit – market access, transitional arrangements and the like – is decidedly more palatable. With some creative labelling and judicious ambiguity in drafting, this could be achieved. However the deal is called and portrayed, the EU-27 will need to see it as a lump sum payment for Britain’s past liabilities.

Finally, the EU-27 will need to be compensated to at least cover the payments gap in the 2014-2020 long-term budget created by Britain’s exit. EU leaders will need to show Britain is making a fair contribution to cover legacy commitments. But the €60 billion is an opening position that is politically unachievable. Pushing Britain to pay for projects that it did not commit to in an annual budget round is unlikely to wash. A bad outcome for the EU-27 is a collapse in talks with Britain over money that immediately precipitates a fall-out among the EU-27 over how to fill the gap. Securing a contribution from Britain will at least delay the looming east-west standoff over money and ‘solidarity’. That is valuable in itself.

So what could a deal look like?

- On exit Britain would pay £14.5 billion16 (approximately €16.9 billion) to the EU, equivalent to its net contribution for 2019 and 2020 had it remained an EU member. This would be part of the UK’s ‘Brexit implementation plan’ costs. It would receive no rebate in 2019, no farming subsidies via the EU, and lose infrastructure spending not channelled via the EIB.

- Britain would negotiate additional EU contributions to cover its future participation in programmes (such as research), market access, or new fees for the use of some EU agencies. (UK payments for pension costs and other long term liabilities could be disguised in post-2020 contributions.)

- Britain would remain a member of the European Investment Bank.

- Costs from contingent liabilities – such as loans to member-states – would be shared as they arise in future.

- An arbitration panel or the International Court of Justice would adjudicate on whether Britain was liable for any investment spending beyond 2019. The UK could pledge to follow the ruling. The EU-27 would accept Britain had honoured its commitments as an EU member.

There are many potential flaws to such a deal. At the moment, both sides would say the terms are unacceptable. It assumes a close enough post-Brexit relationship for the EU to feel confident that the UK would meet the agreed medium and long-term commitments to the EU. Britain would still probably have to separately pay for farm subsidies and half-completed projects. And it banks on a willingness to compromise – and the political space to do it – on both sides. Hardliners may make that impossible.

Theresa May faces a big challenge to avoid playing sister bountiful to the EU. When Margaret Thatcher negotiated Britain’s budget rebate, she drew her bargaining power from a veto that was virtually impregnable and impossible to circumvent, much to the chagrin of her fellow leaders. Time was on her side.

As Britain exits, that balance of power flips. May can refuse to pay, but she cannot just freeze the status quo – she would have to live with the economic consequences of an abrupt, disorderly Brexit. And in this negotiation over EU money, time is running against her.

2: Not all EU budget promises become spending outlays. Around 2 to 3 per cent of regional policy commitments are ‘decommitted’, usually because of legal issues around contracts (such as fraud). But these are a relatively small proportion of overall commitments. The vast bulk of commitments are honoured eventually.

3: During negotiations on the long-term budget, net-contributor member-states such as Britain, Germany, the Netherlands, Sweden and Denmark would doggedly reject the principle that the RAL should be paid off and would insist it was managed through annual payment ceilings.

4: The funds co-ordinated include: the European Regional Development Fund (ERDF), the European Social Fund (ESF), the Cohesion Fund, the European Agricultural Fund for Rural Development (EAFRD), and the European Maritime and Fisheries Fund (EMFF). In total the ESI Funds have a budget of €454 billion for the years 2014-20.

5: Article 76 of Regulation 1303/2013 states: “The decision of the Commission adopting a programme shall constitute a financing decision within the meaning of Article 84 of the Financial Regulation and once notified to the Member State concerned, a legal commitment within the meaning of that Regulation”. Article 85 of the Financial Regulation states: “a legal commitment is the act whereby the authorising officer enters into or establishes an obligation which results in a charge” [for the EU].

6: The figures reflect the narrow “heading 1b” in the EU budget. See Annex 6, Analysis of the budgetary implementation of the European Structural and Investment Funds in 2015, European Commission, 2016.

7: ‘Mid-Term Review Staff paper’, European Commission, September 2016.

8: Calculated from ‘Eurostat study on the long-term budgetary implications of pension costs’, European Commission, July 2016. Various reforms have reduced the benefits to future retirees. The retirement benefits are exempt from tax in EU member-states, covered instead by a relatively low special EU tax.

9: British officials would read this as implying a country must be a member-state, and subject to the EU treaty, for its guarantees to hold.

10: Assuming EU staff levels remain the same, pension costs will keep on rising until the 2040s when the scheme reaches maturity and the number of deceased retirees in a year is matched by the number of new beneficiaries. At its peak in 2046, pension expenditure is expected to hit €2.3 billion a year. The number of beneficiaries will rise from 21,400 in 2014 to 49,100 in 2064.

11: Britain has a 16 per cent share of EIB capital; it accounts for €3.5 billion of the paid-in capital (on balance sheet) and €35.7 billion of the callable capital (off balance sheet). Financing for UK projects represented 8.2 per cent of the EIB loan portfolio at end 2015, making the UK the fifth largest beneficiary.

12: This is quite different from the traditional view of Britain’s net contribution. That looked at public sector receipts from the budget (for agricultural funding, for instance) and money flowing independently to the private sector (research funding). Much of that annual spending would stop once Britain leaves and it is excluded from Britain’s Brexit settlement bill. So for instance in 2013, Britain paid €21.4 billion in gross contributions, and received a rebate of €4.3 billion, public sector receipts of €4.9 billion and private sector funding of €1.4 billion. This brought the net contribution down to around €10.8 billion. See ‘European Union Finances 2015’, HM Treasury.

13: Andrew Stumer, ‘Liability of member-states for acts of international organizations: Reconsidering the policy objections’, Harvard International Law Journal, 2007.

14: Treaty on the Functioning of the European Union, Article 323: “The European Parliament, the Council and the Commission shall ensure that the financial means are made available to allow the Union to fulfil its legal obligations in respect of third parties.”

15: “It is right to say that the international law principle of equitable division applies to certain UK assets and liabilities and that this principle would be important in any negotiation should Scotland vote for independence.” ‘UK debt and the Scotland independence referendum’, HM Treasury, 2013. See also ‘Scotland analysis: Assessment of a sterling currency Union’, HM Government, 2013.

16: ‘Economic and fiscal outlook’, Office of Budget Responsibility, November 2016. Britain provisioned to make a total of £26.4 billion in contributions in 2019 and 2020. The net £14.5 billion is calculated by taking the 55 per cent average net contribution from 2010-2014, taking account of the rebate and public and private sector receipts.

Alex Barker, Brussels bureau chief, Financial Times, February 2017

Comments

Even if the inclusion of Ireland is just a printer's mistake, the financial details of the Irish exit from the UK in 1922 give an interesting historical precedent. Article 5 of the Treaty between Great Britain and Ireland of 6th December 1921 foresaw that the Irish would assume a "fair and equitable" share of the UK national debt as well as pensions including war pensions.

This political agreement removed an obstacle to the signing of the treaty and its subsequent implementation. The negotiation of the actual amount dragged on for years afterwards but was largely negotiated by civil servants way from the political spotlight.

Adopting a similar approach to the financial issues of Brexit would help to defuse the political tension around the UK's liability.

A final thought about any claim on assets. In 1922 there was no question in London that the departing Irish might have some entitlement to a share of the imperial assets and the treaty with Ireland ignores any such possibility. Does the UK, in making a claim for a part of the paltry assets of the EU, wish to re-open some old historical issues around who is entitled to what in the case of a secession?

The report does not take time to justify its consideration of public international law. Given the above, however, it would seem that such a justification is needed. Even if the Commission agreed with the UK government to take the case to the ICJ, it is hard to imagine the ECJ allowing the ICJ to decide the matter if someone were to bring the Commission's decision for judicial review.

Is the author (or anyone else) aware of any precedent in EU law where:

1. The ECJ decided a matter according to the principles of public international law, rather than EU law specifically?

2. A non-EU international court ruled on a matter of EU law and the ECJ consented (explicitly or implicitly) to this?

In other words all treaties cease at that point and all obligations under those treaties.

Anything we choose to agree to pay is nothing more than a bribe for which we would expect something useful

To the poster above who talks of the separation of Ireland - remember that Ireland was part of the UK, ie a part of a nation, they were gaining independence as a nation. There was no legal precedent and a nation is different from a treaty organisation such as the EU. Our obligations to the EU are defined by its treaties, and they cease to apply after March 2019. Nothing in the treaty of Lisbon says otherwise.

So to put it simply we owe nothing.

Any future payment is purely a political discussion about who gains what under what circumstances. I am happy to pay them a bung to reduce the negative impacts of exit, but not otherwise. Any payments should be tied to what we get from them.