The US proposals on digital services taxes and minimum tax rates: How the EU should respond

OECD members are negotiating a global digital services tax and a global minimum corporate tax. EU member-states should support recent US proposals to conclude the talks.

Globalisation and digitalisation allow customers to use foreign digital services or purchase directly from foreign producers more easily, but current international tax rules mean that these producers can often escape paying corporate tax in countries where they make sales. As a result of their frustration about this situation, many countries, including large EU member-states such as France and Italy, have introduced digital services taxes (DSTs), setting them at odds with the US.

Under international tax treaties, a customer’s or user’s home country (referred to as the ‘market jurisdiction’) can generally only tax a foreign producer’s profits if the producer has a permanent establishment in that country, such as a fixed place of business. DSTs depart from this norm. But DSTs suffer from design flaws. They are typically a tax based on revenues, rather than profits, which can harm firms which are not yet profitable. DSTs generally apply only to digital services (DSTs define this differently), disadvantaging the digital economy over the offline economy. Finally, DSTs often include certain revenue thresholds that effectively single out large tech giants based in the US, rather than taxing domestic businesses. This causes friction with the US – the Office of the US Trade Representative has concluded that various countries’ DSTs discriminate against US firms, which may be a precursor to imposing retaliatory tariffs.

The 37 member-states of the Organisation for Economic Co-operation and Development (OECD) are currently negotiating a global replacement for national DSTs, aiming for a mid-2021 agreement. The OECD countries that already have DSTs have generally promised to revoke them in the event of an OECD agreement.

DSTs have been disparaged by many economists and raise relatively little income: for example, the French government estimated its DST would raise €400 million in 2020, which (based on 2019 corporate tax revenues) would amount to less than 1 per cent of corporate profit taxes. Nevertheless, DSTs have become totemic. Many governments believe – probably correctly – that the increase in the number of countries imposing DSTs makes the US more likely to change international tax rules to agree to a global replacement (and less likely to impose retaliatory tariffs). The EU member-states with DSTs generally want the global replacement to be a ‘market jurisdiction tax’, which would give the jurisdiction where a customer or user is located an agreed right to tax a share of a foreign producer’s profits.

The Biden administration has its own agenda in the OECD negotiations: the US is pushing a proposal for a global minimum corporate tax rate that could be applied in addition to a market jurisdiction tax. The minimum tax rate proposal would entitle countries to increase taxation on firms’ profits, if those profits were only taxed elsewhere below the global minimum rate. The intention is to reduce incentives for US firms to shift profits to low-tax countries.

On both these issues, a deal based broadly around the current US proposal is a realistic possibility and is in the EU’s interests.

On the DST issue, the US recently began supporting the principle of a market jurisdiction tax as a substitute for DSTs. But if the OECD negotiations fail to reach an agreement, DSTs will remain in place and their number will probably increase. Then the Biden administration would probably impose tariffs, triggering a new round of damaging trade wars. The design of the US proposal suits EU member-states: it allocates taxing rights between jurisdictions based on sales generated in that jurisdiction, which benefits countries with wealthy consumer bases. The proposal will probably only result in a minimal reallocation of the tax base away from those EU member-states in which the tech giants currently book profits (such as Ireland and Luxembourg). The proposal also corrects many of the defects of DSTs – for example, it would tax a share of producers’ profits, mitigating the impact on firms which are yet to achieve profitability. Most importantly, the proposal provides a face-saving path for EU member-states to remove their own DSTs.

A deal based broadly around the current US proposal is a realistic possibility and is in the EU’s interests.

EU member-states should accept two conditions to reach a deal on a market jurisdiction tax:

- First, the US will require that the market jurisdiction tax is paid by a larger number of multinationals, not solely US tech giants. That concession should not be difficult: it would impose additional taxes on some European firms, but EU member-states would still benefit overall from the proposal. It is not in the EU’s interest to impose higher taxes on the digital than the offline economy, given the EU’s ambition to achieve digital transformation of European businesses, as part of its broader goal of achieving digital sovereignty.

- Second, if the market jurisdiction tax is agreed, the European Commission will probably need to withdraw its recent proposal for an EU-wide ‘digital levy’. The US would insist that any levy that largely hits US tech companies should be revoked, however that levy is justified. Benjamin Angel, director of direct taxation at the European Commission’s Directorate-General for Taxation and Customs Union, has insisted the Commission’s proposal has a “different narrative” from that of the OECD talks, and the Commission maintains that a levy could be designed to be compatible with any outcome of the OECD negotiations. These claims will be unconvincing if the digital levy largely hits US tech companies. The prospect of new tech taxes on US giants would also harm the Biden administration’s prospects of overcoming domestic US political resistance to its proposal.

The proposal for an EU-wide digital levy does not even offer much negotiating leverage. New taxes require the unanimous agreement of EU member-states but most of the member-states which opposed a similar digital levy in 2018 have not changed their minds.

It is also in the EU’s interest to accept the US proposal for a global minimum corporate tax rate.

For EU member-states overall, the US proposal for a global minimum corporate tax could help address a long-running political dispute: the concerns of the European Commission and some higher-taxing EU member-states about ‘harmful’ tax competition with member-states with lower rates. The need for member-state unanimity on most tax matters has prevented any resolution of these concerns to date. Other means to address the issue have also been ineffectual: the Commission’s decision to force Ireland to recover €13 billion in additional tax from Apple was overturned by the General Court of the European Court of Justice and the Commission is appealing that judgment. Many economists consider corporate tax to be inefficient, raising the required profitability of investments and therefore dampening employment and economic growth. This may be true, but complete replacement of corporate tax (for example with consumption taxes) remains politically unrealistic, and the EU’s social democratic model would probably benefit overall from minimising competition between countries to attract investment by driving down corporate tax rates.

For EU member-states overall, the US proposal for a global minimum corporate tax could help address a long-running political dispute.

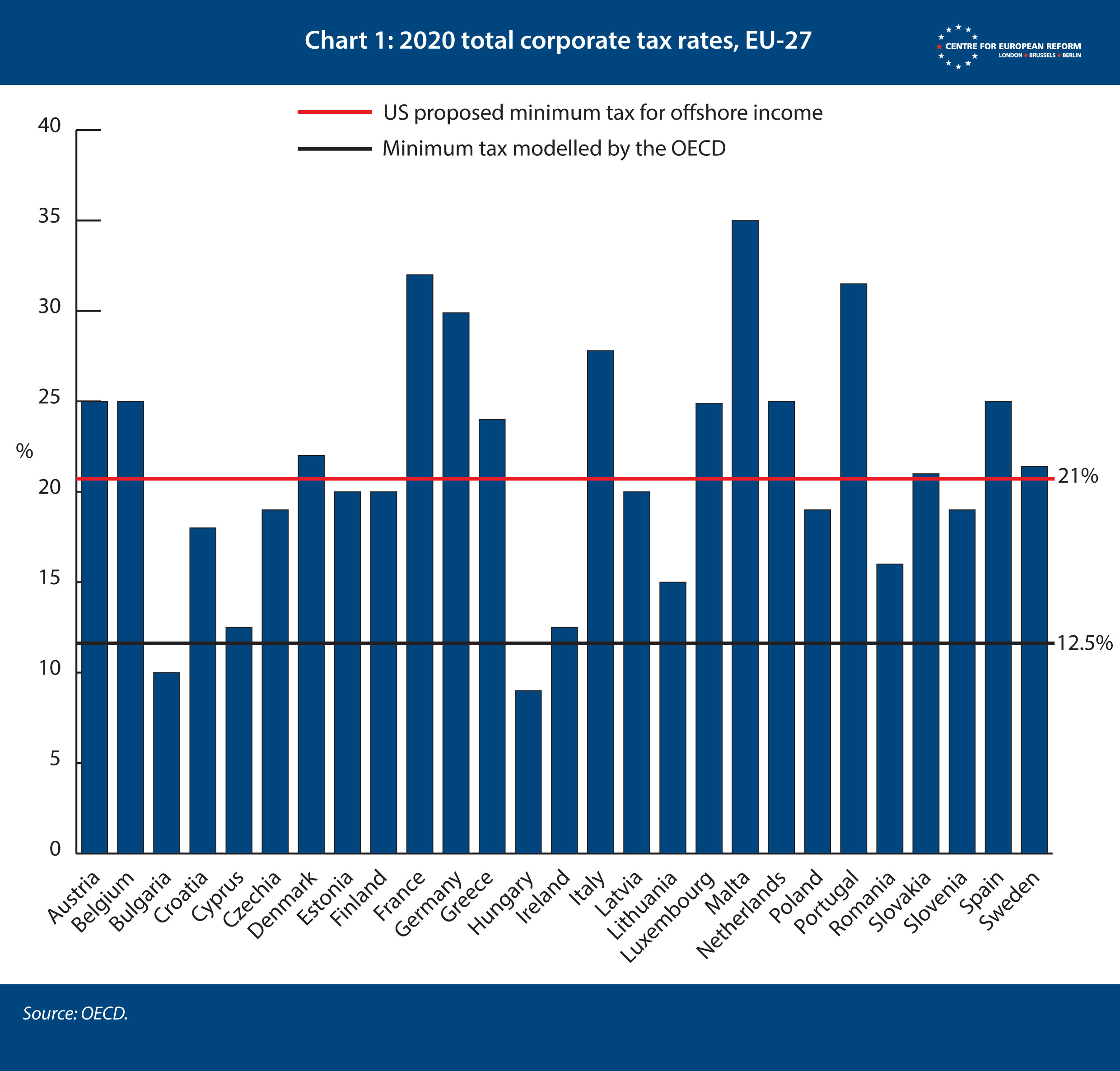

The US proposal will be challenging for some EU member-states. When the minimum tax rate proposal was first raised in the OECD negotiations by the French and German governments, the OECD modelled a rate of 12.5 per cent, which was below the headline corporate tax rates of nearly all EU member-states. The Biden administration now intends to raise the US’s domestic minimum tax on offshore income from 10.5 per cent to 21 per cent (the EU median). The US will try to secure OECD agreement on a rate close to this. As Chart 1 shows, many EU member-states would be affected by such a high minimum tax.

But low-taxing member-states have no real alternative to engaging with the proposal because – regardless of whether international agreement is achieved – the US will use unilateral mechanisms to erode the advantages of countries maintaining low corporate tax rates. For example, the US plans to prevent American corporations claiming certain tax deductions if they shift profits to low-tax countries such as Ireland and Luxembourg. The benefit to countries such as Ireland and Luxembourg of maintaining low corporate tax rates will therefore reduce, even without international agreement. Economic models that rely on a low corporate tax rate have been vulnerable since the US tax reforms of 2017, which ensured some offshore profits of American corporate taxpayers were taxed at a minimum rate.

Low-taxing member-states have no real alternative to engaging with the proposals because the US will use unilateral mechanisms to erode the advantages of countries maintaining low corporate tax rates.

Even so, low-taxing EU member-states have some leverage. The US would prefer to reach an international agreement, which would help mitigate the risk of future ‘tax inversions’, with US firms moving headquarters offshore to escape the US tax regime entirely. Those member-states may therefore prefer to engage constructively to persuade the US to accept a lower minimum rate.

The US negotiating proposals are positive for European governments overall, at least compared to the politically realistic alternatives. The EU should work with these proposals. If it doesn’t, the US may trigger a new round of trade wars and EU member-states’ DSTs will harm the EU’s digital economy. Then, even the lower-taxing EU member-states could end up worse off.

Zach Meyers is a research fellow at the Centre for European Reform.

Add new comment